Multinationals Confront Increased Tax Audit Risk

Multinationals Confront Increased Tax Audit Risk

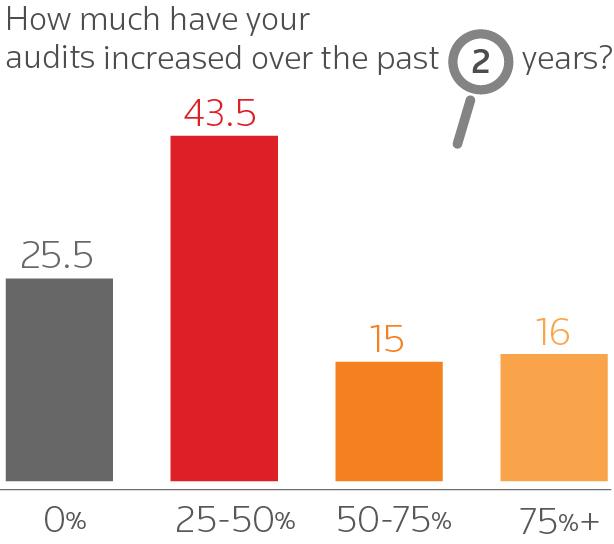

Forty four percent of respondents said their audits increased 25-50% over the last two years, 15% said their audits had increased by a margin of 50-75% and 16% said their audits increased 75% or more. Just 26% said they had experienced no increase in audit risk.

Forty four percent of respondents said their audits increased 25-50% over the last two years, 15% said their audits had increased by a margin of 50-75% and 16% said their audits increased 75% or more. Just 26% said they had experienced no increase in audit risk.

The reasons for this are well-documented in this blog and in other news outlets. Global tax authorities, spurred by big budget deficits, are on the hunt for revenue, and multinational corporations are a huge target.

What is less well-documented is what corporations are doing to contend with the threat of increased tax audit risk. Based on our conversations with hundreds of tax professionals at large companies around the world, these are some of the most common things we’re hearing:

- Reserve Accounts Bolstered: According to an annual study of SEC disclosures conducted this September by the Ferraro Law Firm, Fortune 500 corporations have increased their tax reserves by 2.2% last year. These reserves, which companies maintain to account for any potential tax uncertainties, are used to eliminate wild swings in income that could stem from a tax underpayment. Anecdotally, we’re hearing from clients that their VPs of tax are spending more time explaining to stakeholders throughout their companies why their tax reserves need to be so high, given the general sense of uncertainty around global tax reform. This, of course, is a big issue in the C-suite, where senior management has been cost-cutting to increase profit and does not want to park any unnecessary dollars in reserve accounts.

- More Active Tax Risk Management: I recently wrote about how corporate reputation is influencing tax strategy. With governments and NGOs around the world getting involved with the debate over global tax reform and companies wrestling with more complexity than ever before, tax professionals and senior management do not want to take unnecessary risks. As a result, companies are logging more documentation, providing more transparency and working more closely with their auditors and revenue authorities. Increasingly, the tax department is moving toward working in “real-time” with all stakeholders to avoid potential uncertainties in the future.

- Increased Coordination: One silver lining that has emerged in this period of increased corporate tax scrutiny is a greater sense of coordination between the tax department, finance, accounting and the CFO as these once disparate groups start to realize the need for synchronization of tax policy with global business strategy. Increasingly, multinationals are also evaluating how they organize their tax function, re-evaluating issues such as what parts they manage internally versus what they outsource to accounting firms to get the most from their tax teams.

The common bond with everyone we’ve been speaking with about this issue is an increased need for global coordination. That coordination is starting to occur at large corporations and that is a good thing. Once the weight of ongoing tax reform uncertainty is lightened, it is likely that the increased level of strategic planning involving the tax department will ultimately have a positive effect on the financials of multinational corporations and improve their ability to weather future tax challenges.

http://www.forbes.com/sites/joeharpaz/2013/12/03/multinationals-confront-increased-tax-audit-risk/

Leave A Comment